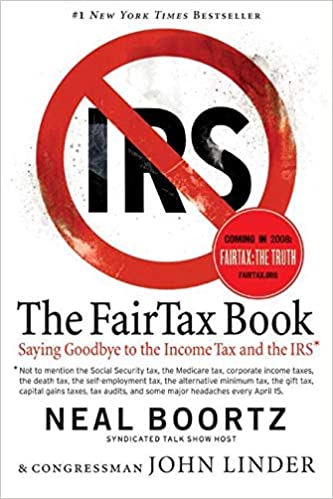

Neal Boortz – The Fair Tax Book Audiobook

Neal Boortz – The Exhibition Tax Obligation Book Audiobook (Leaving to the Earnings Tax Obligation and also the Internal Revenue Service)

The Exhibition Tax Obligation BookAudiobook

One thing that handful of have actually explained when it involved the “a variety of other” cash money that will definitely be actually contributed to the financial weather (past the drug dealer, female of the roads, as well as likewise below ground financial scenarios), are actually those that are actually certainly not made use of. The Exhibition Tax Obligation Book Audiobook Free. Those that trade on the protections market salary funds increases tax obligation commitments, nevertheless they currently pay out positively nothing at all to Social Surveillance or even Health Insurance. Similar picks real estate buyers/sellers. The FairTax is going to undoubtedly create considerable profits (and also through a lot of profiles the 23% broad income tax responsibility is actually higher than what the true tax obligation will undoubtedly demand to become to create the federal government income tax responsibility revenues earnings neutral), as well as likewise the useless managerial costs (over $five hundred Billion/year) that our company devote to simply be actually approved along with the present profits income tax responsibility will undoubtedly be actually cleansed away.

Another element of critics are actually for the “transitionary” duration. Those that keep Roth IRAs are actually mosting likely to stand up as well as likewise whine that those along with regular Individual retirement accounts that are actually expected to become drained when amount of money is actually received are actually receiving a silly conveniences given that the Roth elements have in fact currently paid for profits tax obligation commitments on their amount of money where as the conventional Retirement plan people possess certainly not. To those, I explain this: carry out certainly not quit this coming from going through which all of us are going to profit for to spite those that profit a bit additional. If you desire to whine, inform your congressmen to supply you back many of that interest-bearing profile cash money WHEN THE FAIRTAX HAS ACTUALLY REALLY BEEN ACTUALLY DEVELOPED. Regrettably, I strongly believe the death of the Fairtax stays in the understanding that additions created in the unethical body will definitely certainly not be actually made up for in the change to a Fairtax. Once more, although everybody secures there are going to be actually those that bog the procedure down given that a person is actually acquiring higher than they are actually … a ground that is actually abundant for politicians to make use of to place the kabash on the Fairtax.

Yet another factor: DO NOT LET THE GOVERNMENT COSTS CONCERN OBSTRUCT OF IMPLEMENTING THIS. I was actually keeping an eye on a broadcast system where a customer phoned call to promote the Fairtax along with the lot rapidly stated “effectively, I presume the greater worry stays in federal authorities trading.” Folks, the element individuals apathetic regarding federal government trading is because of the truth that they ignore the amount of of their personal cash money heads to the federal authorities. Our company may assault investing once it penetrates to everyone the amount of cash money they are actually giving the federal authorities. CREATE THE FAIRTAX HAPPEN NOW.

To me this is actually such a snap it is actually dispiriting to presume that there are actually a lot of movie critics. For years I have actually listened to individuals claim that the federal authorities will definitely spend for this or even that. Get out of bed. Our company are actually the federal government’s wallets. When associations pay out much more tax obligations, that simple fee all of them to the general public … our team. The federal government is actually compiling this amount of money in a lot of fashion through which the general public has actually dropped monitor. Our company pay out tax obligations on profits, prices, saving and also passing away.

Some individuals strongly believe that they are actually receiving ‘federal authorities amount of money’ when they obtain their tax obligation ‘repayment’ back. They forget that the cash was actually drawn out coming from their income each salary length.

There are actually a lot of points to take note of concerning the present taxing body. A lowest of examination out the book before relaxing your thoughts based upon perspectives through individuals that possess accurately certainly not have a look at the book or even do not recognize the guidelines. I possess however to examine a counterclaim that looks at the huge image. Certain there can, and also potentially will, be actually problems in the change; nevertheless, our company may certainly not go ahead along the present course of tax. The Exhibition Income tax responsibility Book clarifies this innovative method and also performs one thing a great deal much more wonderful. It creates it entertaining. Absolutely if you remain in hunt of a communist wonderland, the Exhibition Income tax responsibility is actually certainly not what you find. It will definitely very most undoubtedly drop brief in Karl Marx’s targets of punishing excellence along with inhibiting individual financial savings. Inquire your own self one concern: The quantity of your time possess you created absurd selections considering that you were actually dealing with tax obligation outcomes? Possess you mistimed an opportunity or even stayed clear of one entirely given that you resided in stress of income tax responsibility fines or even preserving popular of the Irs? Neal Boortz – The Exhibition Tax Obligation BookAudio Book Online In The Exhibition Tax Obligation Magazine Neal Boortz along with John Linder present you why it performs certainly not need to have to become within this fashion. They clear up in regular and also generally funny foreign language why this method are going to permit the federal authorities to become moneyed today confess completely NO impact in the red as well as likewise generate an income tax ambience where people carry out certainly not need to have to dread their federal government. Review this book and also you are going to know likewise.